US Commercial Real Estate – a Threat to Global Financial Market Stability?

Author - Andrea Otta

The struggling US commercial real estate market is once again catching the attention of investors. Office properties, in particular, are under pressure due to the ongoing trend of working from home. The vacancy rate for office properties is reported to be 13.1% according to a survey conducted by the National Association of Realtors in July of the previous year - an "all-time high." Morgan Stanley, the US investment house, anticipates a 30% price decline (measured from peak levels). Additionally, approximately USD 2 trillion in commercial real estate loans are set to mature in the coming years, requiring refinancing. All in all, these are not favorable prospects.

At the beginning of the month, the US regional bank New York Community Bancorp (NYCB) reported significant losses associated with US office property loans. However, it's not only US banks engaged in this segment. Recently, a smaller Japanese bank, Aozora, reported substantial write-downs in this area, and several German banks have granted billions of euros in commercial real estate loans in the USA.

Institutions from Europe and Japan are also affected

Particularly exposed are the two specialized financiers, Deutsche Pfandbriefbank and Aareal Bank. Also, some regional banks and Deutsche Bank have US commercial real estate loans on their books. Aareal Bank quantifies its commitment at EUR 8.6 billion, with roughly half in office properties. Deutsche Pfandbriefbank reports EUR 4.9 billion in US commercial real estate loans, the majority of which are also office property loans. For both, this represents significantly more than their core capital, and thus, their own funds. This circumstance has recently been addressed by rating agencies in their credit assessments. The credit ratings of both German banks were downgraded by S&P and Fitch but are still seen in the "investment-grade" range. By the way, the credit rating of New York Community Bancorp was already downgraded to "junk" by Moody's.

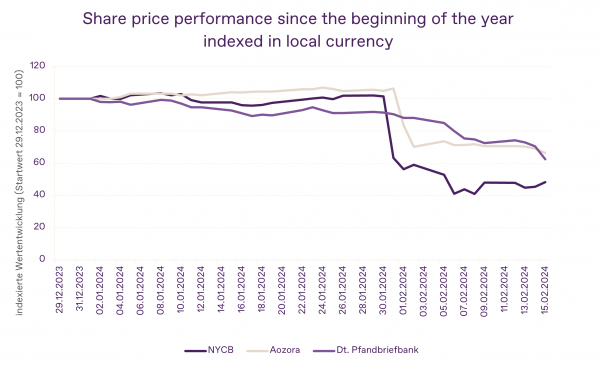

The increasing pressure on banks is evident in stock price developments. Particularly at the more burdened institutions, stock prices have fallen sharply in recent weeks. We have selected three exemplary institutions, as shown in the graphic (Source: Bloomberg Finance).

Do these developments have the potential to shake global financial market stability? Real estate crises have seldom been beneficial for financial market stability. The crucial factor is the volume: According to statistics from the European Banking Authority (EBA), the share of commercial real estate loans for EU banks is "only" around 7% of the total loan volume, and loan-to-value ratios are likely in a comfortable range. Hence, valuation declines alone can be considered manageable for EU banks in total, even if individual institutions are more severely affected. However, it is undoubtedly a topic whose development should be closely monitored.

Disclaimer

This information provides a market overview. It does not contain a direct or indirect recommendation for the purchase or sale of securities or an investment strategy. When investing in securities, price fluctuations due to market changes are possible at any time. Representations of past performance do not provide reliable indications of future results.

Despite all care, data, especially those from third parties, may have changed in the meantime, or unintended and accidental errors may have occurred. Therefore, we cannot guarantee the timeliness, accuracy, and completeness of the information.