Monetary Policy: Emerging Markets Have Already Initiated Interest Rate Turnaround

© Medellin, Colombia / M. Wilnitsky

© Medellin, Colombia / M. Wilnitsky

Author - Florian König

While uncertainty still prevails in the Eurozone and the USA regarding the timing and, more importantly, the pace of potential interest rate cuts, the trend in emerging markets is becoming clearer: monetary policy is already being eased.

Central banks from emerging markets take the lead - again

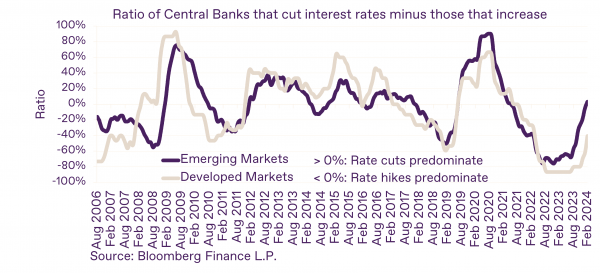

If we recall the years 2021 and 2022, we witnessed a phase where central banks of emerging markets initiated the exit from ultra-loose post-COVID monetary policies. This was followed by a phase of drastic interest rate hikes, which in industrialized countries partly began with a delay of about a year. Currently, a similar pattern is emerging: once again, it is the central banks of emerging markets initiating a monetary policy shift - a cycle of interest rate cuts.

Comfortable Starting Point

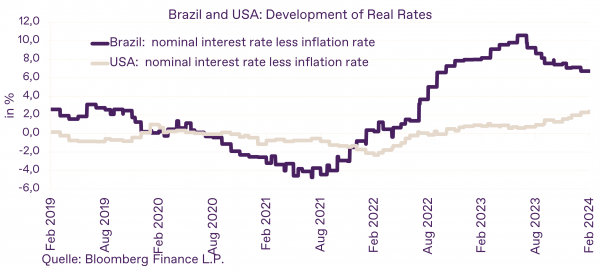

The central banks of the most important emerging markets find themselves in a comfortable position. While in the past there was always trouble whenever the US Federal Reserve made monetary adjustments, it might be different this time. Even with a reduction in the nominal interest rate, a higher real interest rate level could be maintained in the coming months, especially compared to US dollar and Euro-denominated government bonds. This could be further reinforced by the fact that US Federal Reserve interest rate cuts counteract the positive US real interest rate development and could weaken the US dollar. However, exchange rate fluctuations due to market changes are always possible. At the same time, the ongoing easing is expected to generate positive economic impulses for the affected economies. This is evident in the case of Brazil: starting from an extremely attractive real interest rate level, the Latin American heavyweight has enough room to lower the nominal interest rate.

Specific Country Risks and Game Changer US Elections

A selective approach to country selection and weighting is still advisable. We advocate for a strategic and tactical selection and allocation. The former is essentially based on the importance of individual emerging markets measured by the outstanding bond volume and the question of whether there are factors that make a fundamental investment impossible or unattractive. Compared to previous periods, we continue to avoid investments in the Egyptian Pound and the Kazakh Tenge. At this point in time, we do not see these countries as an investment case, partly due to their geographical location. Tactical adjustments are derived from trend and momentum indicators as well as relative purchasing power parity. Current yield is also taken into account. Based on our model, we consider the Latin American region, with Mexico, Colombia, and Brazil at the forefront, particularly attractive. Looking ahead to the US presidential elections, emerging markets could navigate into more volatile waters. A wave of protectionism could hit the economies of emerging markets hard. In any case, it is advisable for emerging markets to opt for an approach of engagement rather than confrontation with the respective election winner.

Fund Assets Reach Significant Milestone

The high demand in the bond sub-asset class is also reflected in our growth. The Kathrein Sustainable EM Local Currency Bond Fund recently surpassed the €100 million mark. The strategy is implemented with a sustainable approach, meeting the requirements of the Austrian Ecolabel, the FNG Seal, and the FinAnKo criteria (Ethical Investment Directive of the Austrian Bishops' Conference and Religious Communities of Austria). We exclusively invest in supranational institutions such as the European Investment Bank or the International Finance Corporation. This has the advantage that these institutions have very high credit quality, issue bonds in the respective national currencies, and thus offer attractive returns.

All details regarding the funds

Disclaimer

This information represents a market overview. It does not contain any direct or indirect recommendation for the purchase or sale of securities or an investment strategy. Price fluctuations due to market changes are possible at any time when investing in securities. Representations of past performance do not provide reliable indications of future results.

The current prospectus or information for investors according to § 21 AIFMG, as well as the key information document of the fund, are available in paper form upon request from Kathrein Privatbank, as well as on www.kathrein.at under "Investment Solutions / Our Funds" in German. There, you will also find the link to the summary of investor rights. The management company may suspend the distribution of fund shares outside the fund's domicile country, Austria.

Fund Note: If necessary, there may be a higher concentration of issuers within the investment fund portfolio, with the following provisions applied: Securities or money market instruments issued or guaranteed by one of the following issuers may be acquired for more than 35% of the fund's assets, provided that the investment is made in at least six different issuances, and investment in the same issuance does not exceed 30% of the fund's assets: European Bank for Reconstruction & Development. Due to the use of investment instruments allowed according to the fund regulations, the investment fund exhibits increased volatility, meaning that the share values are exposed to significant fluctuations both upward and downward within short periods. The management company may conduct derivative transactions as part of the investment strategy for the investment fund. This may increase the risk of loss regarding assets held in the investment fund. Derivative instruments may also be used for hedging purposes. The fund regulations of the investment fund have been approved by the Financial Market Authority.