Gold soaring to new heights: What's behind it?

Author - Harald Besser

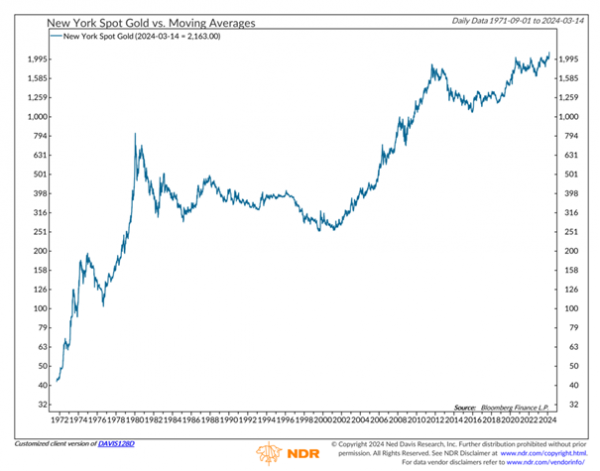

The price of gold reached a new all-time high in March 2024. Over the past few months, the precious metal has experienced an impressive rally. Is this the beginning of a new golden era, akin to the 1970s following the oil crises or the period post-2000 after the bursting of the Dotcom bubble and the financial crisis?

Goldprice since 1971 (Source: Ned Davis Research):

Note on the illustration: Past performance is not a reliable indicator of future results. For investors with a home currency other than USD, returns may rise or fall due to currency fluctuations. Data as of 14.03.2024.

Historical Evolution

Examining the long-term trajectory of the gold price, a significant increase can be observed. The rallies in the 1970s and after the turn of the millennium were particularly pronounced. In both phases, geopolitical tensions and economic uncertainties fueled demand for gold as a safe haven. Several factors are currently driving the price of gold:

• The war in Ukraine and the associated tensions between Russia and the West have significantly boosted demand for safe havens such as gold.

• Geopolitical tensions between China and the USA are a significant factor contributing to the recent rally in the gold price. The complexity of global economic relationships means that such geopolitical events can have far-reaching implications, which also manifest in the flight to safe havens such as gold.

• Persistent high inflation in many parts of the world raises concerns that the purchasing power of money could decline. Gold is considered a traditional hedge against inflation.

• Central bank purchases: World central banks have been steadily increasing their gold reserves in recent years. This signals their ongoing support for the gold price.

• Technical factors: Strong demand for gold has led to increased speculation in the gold market. This can further boost the gold price.

• Diversification: In periods of uncertainty, investors tend to diversify their portfolios more broadly to reduce risks, with gold being particularly valued due to its low correlation with traditional asset classes such as stocks and bonds.

Predicting the future trajectory of the gold price is difficult and subject to many influencing factors. Given the current conditions, a continuation of the upward trend is possible.

Our offering for gold

Kathrein offers various ways to profit from the development of the gold price:

• Gold depot: With a gold depot, you can buy physical gold and store it securely or deposit it into an account.

• In our equity funds: These funds invest, among other things, in mining companies that produce gold and other precious metals.

• Gold ETCs: These funds track the price of gold and enable easy investment in the precious metal.

• Sustainably mined gold: As the latest addition to the gold offering, investors at Kathrein now have the opportunity to purchase sustainable gold (LBMA certified). LBMA-certified gold is produced responsibly, with attention to both social and environmental aspects.

If you are interested in investing in gold, Kathrein is ready to assist you with our expertise.

Disclaimer

This information provides a market overview. It does not constitute a direct or indirect recommendation to buy or sell gold or securities, or an investment strategy. When investing in gold or securities, fluctuations in prices due to market or currency changes are possible at any time. Representations of past performance do not provide reliable indications of future results.